1. Introduction

Salesforce Financial Services Cloud is a robust CRM system designed to meet the specific needs of the financial services industry. With a comprehensive data model, the platform excels in managing client information, accounts, and records, providing a 360-degree view of individual and household financial data. The integration of features like dashboards, services, and tabs enhances visibility and facilitates efficient tracking of client interactions.

One of the key advantages of Salesforce FSC is its ability to create customized processes, empowering advisors and bankers to tailor their approach based on client needs. The platform's flexibility is evident in its adoption of Lightning components and workflows, providing a user-friendly interface for easy navigation. The ability to migrate and update data ensures that important information is always up-to-date, contributing to a streamlined workflow.

This article acts as a compilation for everything financial institutions need to know and consider when trying Salesforce FSC for themselves.

2. Understanding Salesforce Financial Services Cloud

Salesforce released Financial Services Cloud (FSC) in 2016 — initially to serve the wealth management market. Salesforce has been working to improve and innovate the product ever since. It has expanded to retail banking, commercial banking, and insurance to become a one-stop solution for the modern bank.

Take a look below at a timeline of innovations for FSC.

Core functionality of Salesforce FSC

Customer Relationship Management (CRM)

Financial Services Cloud (FSC) offers a diverse partner ecosystem, integrating seamlessly with financial planning tools, compliance solutions, and more. Its standardized data model simplifies representation of financial accounts and goals, reducing customization time and costs for firms in the financial services sector.

Operating on CRM principles fundamental to the industry, FSC centralizes client information into a unified data model, ensuring consistency and accuracy across financial accounts, interactions, and goals. Customization options allow tailoring the CRM to specific institutional needs, enhancing operational efficiency.

FSC consolidates client information from various sources, providing advisors with a comprehensive understanding of their financial situations and needs. This enables personalized communication and tailored financial planning. Additionally, FSC streamlines task management for client interactions, from scheduling meetings to tracking significant events, facilitating a more efficient client relationship process.

Data Management and Analytics

Salesforce FSC employs the Salesforce data model for structured customer data management, covering clients, accounts, transactions, and related financial information. It represents individuals and their activities through person accounts or the individual model, with person accounts favored for B2C operations.

Data includes personal details and interactions with the organization, along with connections to Salesforce transactions and communications. The individual model combines Account and Contact objects with custom enhancements, supported for FSC organizations with existing implementations.

The convenient Tear Sheets feature simplifies the reporting process by allowing users to view, download, and email generated tear sheets directly from the record page where the report creation was initiated. Users can create new tear sheets by selecting relevant templates from components on record pages for accounts, contacts, and financial deals. The platform supports the definition of multiple templates, catering to diverse contexts in client meetings and providing a customizable reporting solution.

Personalization and Engagement Tools

Salesforce Financial Services Cloud (FSC) incorporates various personalization and engagement tools to enhance the customer experience in the financial services sector.

- Configurable Group Builder

Administrators have the ability to customize the display of sections, allowing users to concentrate on specific types of relationships that are pertinent to them. This customization includes choosing which fields, including custom ones, to show and determining the order in which they appear.

- Customer Profile

Enables to work on attributes within the financial customer data model, encompassing aspects like Know Your Customer (KYC), Interests, Communication Preferences, Client Servicing, and Finance Profiling. Financial Services Cloud (FSC) accommodates a diverse range of financial accounts, such as checking accounts, savings accounts, mortgages, credit cards, investment accounts, 401(k) accounts, and insurance policies.

Source: Salesforce.com

In addition to documenting intricate, multi-party relationships through groups, Financial Services Cloud also models one-to-one relationships connecting individuals and businesses. These relationships contribute to a better understanding of spheres of influence and spans of control.

Users can establish financial goals to monitor a client's advancement towards significant purchases, retirement savings, or other life objectives. The system also facilitates the identification and capture of customer needs through referrals, enabling proactive efforts to fulfill those needs.

- Interest Tags

Always prioritize the interests of both business and individual customers. Establish a shared interest tag dictionary for universal use within the organization. Enable advisors to label their customers using terms from the global tag dictionary, and allow authorized users to seamlessly contribute to the collection of common tags. Utilize an improved tagging user interface to easily view and assign multiple customer interests. Enhance the search functionality to provide a more robust experience across Interest Tags and their respective categories.

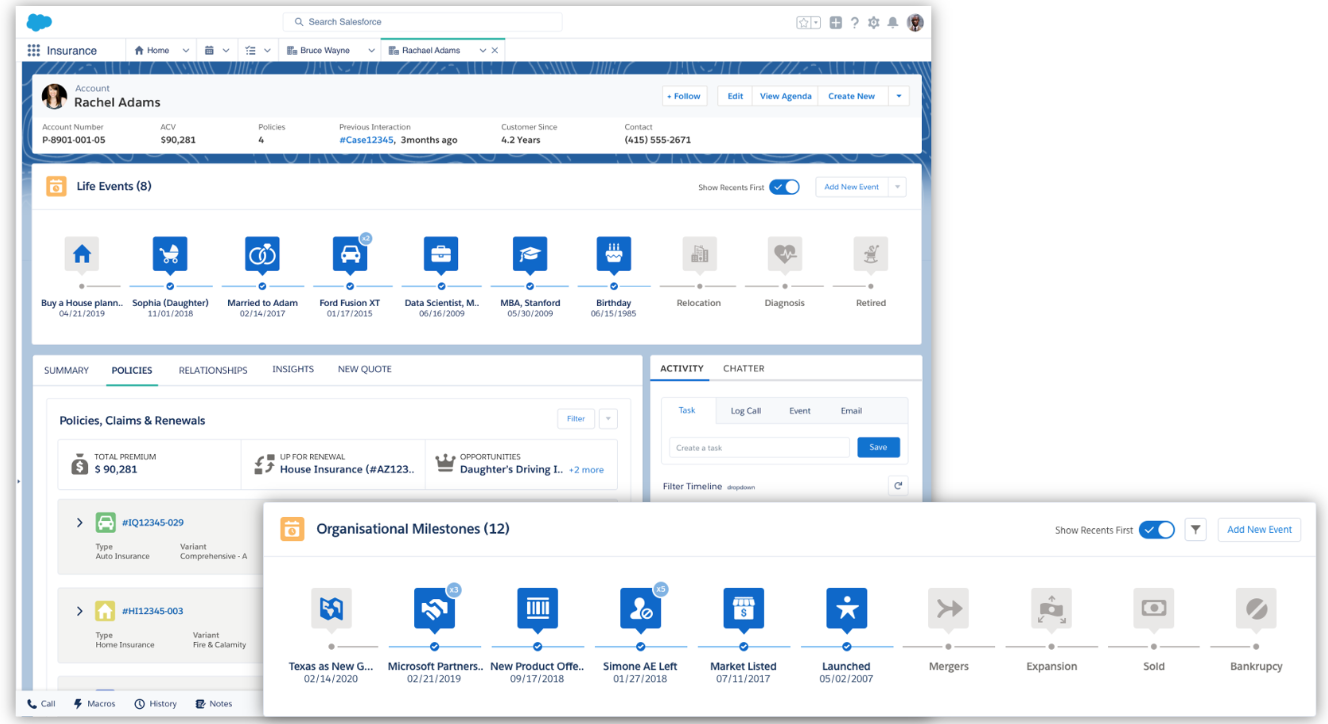

- Life Events & Milestones

Monitor significant life events of your customers and engage with them on a personal level throughout their life journey. Assess the impact and success of your initiatives through the tracking of Events.

Source: Salesforce.com

- Referral Management

Facilitates the generation of referrals across various business segments:

- Referrals initiated by Employees, Partners, and Clients

- Options to Accept, Reject, or request additional information

- Monitoring, Visibility, Report generation, and Dashboard functionality

- Consistent presence throughout the entire conversion process

- OmniScript

OmniScript is a user-friendly, non-coding tool designed for creating intricate business processes.

Source: Salesforce.com

Financial institutions can utilize OmniScript to build dynamic customer interactions that lead users through sales and service procedures. It enables quick, personalized responses and integrates seamlessly with crucial data sources.

- FlexCards

FlexCards empower the creation of sophisticated user interfaces effortlessly, eliminating the need for custom code. Admins can utilize a click-based configuration to design FlexCards by arranging and sizing elements like fields, buttons, links, labels, icons, images, and charts on the designer canvas. To expedite integrations, a Datasource Wizard automatically populates a FlexCard with data from various sources.

Source: Salesforce.com

These FlexCards are automatically compiled into Lightning Web Components and can be easily added to a page using the Salesforce App Builder. This simplifies and enhances business processes by presenting only the necessary data at the right moments.

- Business Rules Engine

The Business Rules Engine empowers financial organizations to make agile and customizable automated decisions. This tool allows the configuration of intricate rating processes using factor tables, functions, and arithmetic. Rules can be constructed using expressions or more concise lookup tables, providing support for industry standards.

- Action Plan

Leverage Action Plans to oversee customer engagement processes across diverse financial services sectors like Banking, Insurance, and Wealth Management. Enhance customer experiences consistently through customizable task templates. Boost productivity by automatically generating tasks with assigned due dates and roles. Encourage collaborative and compliant task completion through analytics and enforcement of necessary tasks.

Source: Salesforce.com

Additionally, automatically generates Action Plans based on templates at regular intervals, such as monthly or quarterly. This system also allows the inclusion of relevant collateral, comprising one or more files, associated with the entire Action Plan.

Integration capabilities with other systems

Salesforce Financial Services Cloud offers an API-centric approach. Its middleware compatibility, real-time data exchange, customization options, and security protocols empower financial institutions for technological transformation.

Integration Procedures within FSC facilitate declarative, server-side processes for executing multiple actions in a single server call. Managing diverse data sources including Salesforce and external systems, it retrieves data for applications like OmniScript, FlexCard, API, or Apex, boosting operational efficiency.

Utilizing Salesforce Financial Service Cloud to its fullest potential requires seamless integration with the systems already in place within financial institutions. By linking with core banking platforms, portfolio management systems, and other pertinent applications, the Financial Service Cloud serves as the primary hub for accessing vital client information and optimizing operational processes. This interconnectedness facilitates a comprehensive understanding of clients, empowering financial advisors and relationship managers to offer tailored services and foster meaningful interactions.

FSC effortlessly links financial, transactional, and CRM data, accommodating various solutions from pre-made integrations to tailored developments. This capability guarantees a comprehensive perspective and handling of customer data across diverse platforms.

If you’re in financial services, you work with a specialized set of needs when it comes to data management and migration.

The Financial Services Cloud (FSC) Transition Assistant is a free tool that simplifies the migration process to FSC by handling discovery, gap analysis, and data mapping between your current setup and FSC. It aids in all stages of implementation, from scoping to rollout.

Integration partners can utilize the tool and deliver the report output to their clients. In this scenario, the Transition Assistant offers the following kinds of information:

- Automatically created metadata aiding in mapping the current organization's data model to the FSC objects and data model.

- Comprehensive list of potential conflicts and elements that could be impacted by the migration.

- Identification of components needing manual migration, should the client opt for metadata migration.

3. Salesforce Financial Services Cloud for financial institutions

Banking

- Customer Relationship Management: Enhances the banking customer experience by providing a 360-degree view of the customer, facilitating personalized service and offers.

- Loan and Mortgage Management: Streamlines the loan origination process and mortgage management, making it easier for banks to track applications and engage with customers throughout the loan lifecycle.

- Financial Health Assessments: Uses AI-driven insights to offer financial health assessments, helping bankers provide tailored advice and solutions to customers.

- Commercial Banking: Bankers get greater visibility into customer relationships in commercial lending, treasury management, trade finance, and more with the Commercial Banking Console app. Plus, a Business Referrals record type makes it easy for relationship managers and lending assistants to make business-to-business referrals.

- Retail Banking: Get a 360-degree view of customers with Retail Banking, a Financial Services Cloud Lightning app. Bankers can also easily manage high-volume transactions on one screen with the Retail Banking Console. The information bankers need is supported with new objects, fields, and record types for loans, deposits, and more.

Wealth Management

- Client Relationship Management: Offers wealth managers a comprehensive view of client portfolios, enabling personalized investment advice and better wealth management strategies.

- Automated Financial Planning: Facilitates the creation of automated, personalized financial plans based on client data, improving client engagement and satisfaction.

- Regulatory Compliance: Ensures compliance with financial regulations, reducing the risk for both the firm and its clients through systematic data management and reporting.

Insurance

- Policy Management and Servicing: Simplifies policy management, from underwriting to claims processing, enhancing the efficiency of insurance operations.

- Customer Engagement: Improves customer engagement through personalized communications and services, increasing loyalty and retention.

- Claims Processing: Automates and streamlines the claims processing workflow, reducing processing time and improving customer satisfaction.

Salesforce FSC in action

RBC Wealth Management is a great example of a successful digital transformation in the financial sector, showcasing the impact of Salesforce's Financial Services Cloud. Faced with challenges from outdated CRM tools, RBC opted for FSC, unifying client data from legacy systems and improving advisor efficiency. The implementation, completed within nine months, enabled rapid rollout to advisors and clients, addressing technological limitations and enhancing reporting capabilities.

The adoption of Tableau CRM (formerly Einstein Analytics) further empowered advisors with personalized offer recommendations, shifting focus to high-value opportunities. The results were outstanding, with a 90% adoption rate and improved client relationships. Notably, RBC witnessed its best recruitment success and high retention rates, indicating the transformative effect of digital capabilities in the industry.

4. Benefits to the business

Enhancing customer experience and relationship management

FSC enables financial services institutions to build trust by unifying the customer experience across channels, geographies, and lines of business—both consumer and commercial.

Customers have adapted to a digital lifestyle and expect the same connectivity and personalization they receive everywhere else. This leads over into the financial services realm, where customers want to be able to manage their finances from anywhere, 24/7.

Improving operational efficiency and productivity with Salesforce FSC

Unify the Financial Experience

- B2C & B2B Data Model

- Relationship Groups, Builder & Mapping

- Financial Summaries & Rollups

- Financial Accounts, Holdings, Securities, Treasury Services, Assets & Liabilities

Book of Business Analytics (Client Segmentation)

- Pre-built dashboards, metrics & dataflows with Einstein Analytics.

- Easy visibility and ability to segment Book of Business for each Advisor.

- Take one-click actions from List View.

- Get trends & segment client based to evaluate activity effectiveness.

Performance Management

- Branch/Business Unit Management

- Role Based Consoles

Service Excellence

- Financial Accounts & Transactions

Engagements

- Consolidate all Interactions happening during a session

- Integrate with Service Cloud Voice

- Supports sharing features for Engagement entities including manual sharing, role hierarchy, sharing settings page, OWD jobs, change owner, queue enabled, and more.

Timeline

- Flexible anchor object

- Configurable event details

- Summarization, Filtering, and Sorting

- Multiple form factors

- Intuitive Admin experience

Identity Verification

- Custom Admin Setup

- External Database Search

- Multi-Object Search

- Verification Trail Auditing

Compliance and security features

Enforcing compliance helps ensure financial services organizations prevent and detect violations of rules, which protects the organization from fines and lawsuits. It also helps enhance trust with customers. See below how FSC can help facilitate proper compliance alignment.

- Deal Improvals - Ensure deal team members are approved after clearance from any conflict of interest or via ‘wall crossing’ from the public side.

- Compliant Data Sharing - Automatically share client interactions and deal-related data based on rules and access levels defined by compliance.

- Participants Management - Manage participants and the roles that they play in the context of a parent record.

- Data Sharing - Automatically share data with participants based on the role they play in the context of a parent record.

- Compliance - Approve participants before sharing any sensitive data with them.

- Platform extension - Leverage various platform features to extend this feature.

- Define consent - Analysts can define which kind of disclosures and consent need to be shared and collected during a particular business process.

- Generate Consent Authorizations - Relationship managers, loan officers, and any other bank representatives working with customers can generate and send consent requests.

- Gather Consent from Client - Allow end clients to agree to disclosure policies before starting or continuing a business process.

5. Implementation Strategy

Planning and preparation steps

1. Lightning Experience.

Financial Services Cloud requires that users are in Lightning Experience. If you are not using Lightning Experience, the vast majority of the underlying FSC functionality won’t work. Data will not look accurate, and users will be frustrated. If you’re going to pay for the feature, you should use it as intended.

2. My Domain.

One of the first steps in implementing Financial Services Cloud is to ensure that My Domain is enabled and deployed for the Org. The vast majority of FSC functionality drives off of custom Lightning components which require that My Domain is activated. This is a requirement.

3. Profiles and users.

- Enable the Contacts to Multiple Accounts Feature: Setup → Account Settings → select “Allow users to relate a contact to multiple accounts”

- Create Profiles for Users: Use profiles to grant advisors, personal bankers, and relationship managers access to Financial Services Cloud features. To create the required profiles, clone and customize the Standard User profile provided by Salesforce.

- When you install the Financial Services Cloud packages, map these cloned profiles to the Advisor, Personal Banker, and Relationship Manager profiles provided in each package.

- From Setup, enter Profiles in the Quick Find box, and then select Profiles.

- Clone the Standard User profile.

- Give it a name, such as Advisor.

- Save your changes.

- Repeat to create the Personal Banker and Relationship Manager profiles, etc.

4. FSC package installation.

There is a Managed and Unmanaged package for FSC. The managed package contains most of the Financial Services Cloud functionality. This functionality includes custom fields and objects, list views and profiles of clients and households, and administrative configurations.

- In the Product Specific Terms section of your order form, copy the URL for the Financial Services Cloud managed package.

- Paste the URL into your browser navigation bar, and press Enter.

- If you received a password from Salesforce, enter it.

- Select Install for Specific Profiles.

- Scroll to the Select Specific Profiles section, and map the profiles that you created in the pre-installation tasks to the package profiles.For the Advisor profile, set the access level to Advisor. For the Personal Banker profile, set the access level to Personal Banker. For the Relationship Manager profile, set the access level to Relationship Manager.

- Click Install

Install the unmanaged extension package after you install the Financial Services Cloud managed package. The unmanaged package extension for Financial Services Cloud Service Processes for retail banking offers pre-configured and customizable retail banking service processes built using Service Process Studio. Each process includes an OmniScript for request intake through assisted and self-service channels. It features flows and email templates for streamlined fulfillment, and BIAN-inspired outbound Mulesoft APIs for integration with core banking and other external systems.

The unmanaged package extension for Financial Services Cloud Service Processes for Wealth Management offers pre-configured and customizable wealth management service processes built using Service Process Studio. Each process includes an OmniScript for request intake through assisted and self-service channels. It features flows and email templates for streamlined fulfillment, and BIAN-inspired outbound Mulesoft APIs for integration with Custodial or Books and Records platform.

5. Post-installation tasks (not required, but nice to have).

- Configure Navigation to Individual and Group Profiles: Standard URLs that point to account and contact detail pages require a different navigation path for an individual’s information. When users interact with detail page links, you want them to navigate to an individual or group profile, not the individual’s account or contact record. You can configure overrides to redirect these URLs;

- Lightning Pages Setup: Assign Financial Services Cloud home pages to different apps and app-and-profile combinations to give your users access to a Home page perfect for their role. You can assign different Lightning pages to the various Financial Services Cloud apps to display specific account record types. You can also choose which profiles can access the page. The two-column page layout is ideal for the Retail Banking app, the one-column layout is best suited to the Retail Banking Console, and the three-column suits both apps;

- Add Values to the Lead Status & Opportunity Stage Picklists;

- Configure User Profile Permissions: Enable the required permissions and a field-level security setting for the user profiles, including the System Administrator profile. You can edit profiles that you created and mapped to the packaged profiles. However, you can’t change the packaged Advisor Access, Personal Banker Access, and Relationship Manager Access permission sets. If you want to add or remove permissions, clone the packaged permission and modify the new version;

- Page Layouts and Global Actions Setup: A global action lets users easily record details about client tasks, events, and calls by launching an action from the Salesforce header;

- Give relationship managers, personal bankers, and advisors access to the fields in the account contact relationship layout to let them create and maintain relationship groups.

Best practices for deployment and data migration

There were instances in our practice where consultants didn’t understand the data model well and the data was loaded incorrectly. Just like with any data migration or import, it’s important to understand the data model and the order of operations needed to import data.

However, FSC adds some extra complexity to the data model around the Account structure. If the Individual records are not defined and imported correctly (i.e., you only need to create the Individual Account or Contact record – not both), you could end up with duplicates or very messy data.

Data migration best practices

Data Cleansing:

- Cleanse and validate existing data before migration to ensure accuracy and consistency;

- Identify and rectify any duplicate or outdated records.

Data Mapping:

- Create a comprehensive data mapping strategy to map fields and attributes from the source to the target system;

- Clearly define data transformation rules to maintain data integrity.

Data Validation:

- Implement validation checks during the migration process to identify and address any data discrepancies;

- Utilize validation scripts and tools to verify the accuracy of migrated data.

Backup and Rollback Plan:

- Conduct regular backups of data before migration to mitigate the risk of data loss;

- Develop a rollback plan in case of unexpected issues during the migration process.

Data Governance:

- Establish data governance policies to ensure data quality and compliance with regulatory requirements;

- Define ownership and accountability for data management within the organization.

Performance Monitoring:

- Monitor the performance of the system post-migration to identify and address any issues promptly;

- Implement performance benchmarks to measure and optimize system performance.

Deployment best practices

Thorough Planning:

- Begin with a comprehensive planning phase that includes a clear understanding of your organization's requirements, goals, and processes;

- Define the scope of the deployment and establish realistic timelines and milestones.

Customization Strategy:

- Leverage out-of-the-box features whenever possible to minimize customizations;

- Prioritize customization based on business-critical needs, ensuring they align with long-term goals.

User Training and Adoption:

- Invest in user training programs to ensure your team is well-versed in the new system;

- Promote a change management strategy to facilitate smooth adoption across the organization.

Testing:

- Implement a robust testing strategy, including unit testing, integration testing, and user acceptance testing;

- Test data integrity, security settings, and business processes thoroughly.

Incremental Rollouts:

- Consider a phased or incremental deployment approach to minimize disruption and allow for continuous feedback.

Collaboration with Stakeholders:

- Involve key stakeholders from various departments in the deployment process to ensure the solution meets diverse business needs.

Overcoming common challenges and pitfalls

FSC is similar to the Non-Profit Starter Pack in that it’s a managed package. While the package updates with each Salesforce release, not all features auto activate. It’s vital that Admins and Consultants working with FSC clients are aware of this, and take the time to review what is coming out in the release, and what if any are required manual updates. Yes, some manual updates must take place. If these updates do not take place, some pieces of FSC can break.

Additionally, there are limitations to manage packages that are at play here with FSC. For example, we had a client who wanted to change the field labels for some fields on the Financial Account object. Because the fields are part of a managed package, we were unable to rename the field labels.

The natural next step would be to create new fields on the object to mimic what the field is doing, but call it something different. However, this presented a few problems:

- Problem 1: IT’S NOT A BEST PRACTICE! – Creating entirely new fields to replace standard fields is not a best practice at all. It may seem inconvenient to use what is provided but will save time and money in the long run.

- Problem 2: Standard Functionality Suffers – FSC and Salesforce at large have a lot of standard functionality that operates from the standard fields. What we found out was that even some of the seemingly benign fields on the Financial Account had an impact on how data rolled up to the account. There is a lot of behind the scenes functionality in FSC and messing with these standard fields can cause problems.

There is one workaround that could be leveraged if the field labels absolutely need to be renamed, and that is to leverage Translation Workbench to modify the field label. Regardless, ensure that you are regularly updating the installed package with each release and that you always start by using the standard fields provided by Salesforce.

Another issues we faced in sandbox(es) after FSC installation and/or PROD refresh were related to RBL (Packaged Rollup By Lookup Rules Configurations). This is one of the most important features of FSC as it enables summary calculations for Accounts.

We tried to fix this by importing the RBL data from PROD. We exported all RBL records and tried to import into DEV instance. But faced issues for some records related to “WHERE“ clause filtering (FSC internal error).

The most important rules are deactivated as no filters are provided and those rules are responsible for rollup summary calculations.

If the user tries to update the rules and sets a proper “WHERE“ column value, FSC throws an error and prevents the action.

During the investigation, we identified that not only RBL data was missing, but their dependent Rollup By Lookup Filter Criteria.

Rollup changes in records don’t always trigger active RBLs rules. Three general conditions are evaluated.

- Are the Enable Group Record Rollups and Enable Rollup Summary Wealth Management Config custom settings selected for the user who made the change?

- Is the record type ID for the affected record included in the RBL?

- If there’s a Where Clause, does it evaluate to true?

When all three conditions are true, either the appropriate RBL rules are triggered to run or an Apex job that will trigger the appropriate rules is queued.

RBL rules are made up of two Financial Services Cloud objects: Rollup By Lookup Configuration and Rollup By Lookup Filter Criteria. Rollup By Lookup Configurations define rules for calculating rollup fields. Rollup By Lookup Filter Criteria define criteria for calculating rollups.

We imported Rollup By Lookup Filter Criteria data from PROD to DEV environment and linked to proper RBL records. This action resolved the issue and calculations started working properly.

6. Customization and Adaptation

While Financial Services Cloud offers a rich set of out-of-the-box features, every financial institution operates uniquely, with distinct processes, regulatory requirements, and business objectives. Therefore, customization plays a critical role in maximizing the value derived from the platform.

Here are several main areas where customization can be employed:

1. Data Model Adjustment: Modifying the data model to capture extra client details, financial products, or industry-specific data fields ensures smooth alignment with the organization's data structure and reporting requirements.

2. Workflow Streamlining: Creating tailored workflows and automation rules simplifies routine tasks like client onboarding, account management, and compliance procedures, thereby enhancing operational efficiency and minimizing manual errors.

3. System Integration: Connecting Financial Services Cloud with existing systems such as core banking platforms, portfolio management tools, or regulatory reporting systems facilitates data synchronization and improves overall cross-platform functionality.

4. User Interface Tailoring: Adjusting the user interface to reflect the organization's branding standards and user preferences encourages user adoption and elevates the overall user experience.

5. Compliance and Security Settings: Implementing customized security measures, data encryption, and access controls ensures adherence to industry regulations and secures sensitive client information.

6. Enhanced Analytics and Reporting: Developing personalized reports, dashboards, and analytics tools tailored to specific business metrics and key performance indicators (KPIs) enables stakeholders to derive actionable insights and make informed, data-driven decisions.

7. Client Engagement Enhancement: Crafting bespoke client portals, communication templates, and marketing automation workflows enhances client interaction and strengthens relationships with clients.

7. Salesforce’s plans for Financial Services Cloud

Salesforce exemplifies this belief with FSC, consistently innovating with 24 releases in the eight years since its launch. This dedication to refinement and focus on the financial sector's specific requirements has not gone unnoticed. Salesforce's commitment to excellence in this domain was recognised when it was named a leader in The Forrester Wave: Financial Services CRM for Q3 2023. Their sector-specific approach ensures that businesses get solutions optimised for their unique challenges, enhancing efficiency and customer satisfaction.

The 2023 edition of Dreamforce – the pinnacle of all things Salesforce – shed light on the usually reserved discussions about the FSC roadmap. With the sessions now available for deeper exploration on Salesforce+, let's unpack the strategic directions Salesforce is taking and what it signifies for the broader financial landscape.

- Investment in Personalisation and Proactivity: At the heart of Salesforce's strategy is the clear commitment to enhancing personalisation for customers. By harnessing the power of data, AI, and CRM, Salesforce aims to dive deep into business process automation, ensuring that every interaction is tailor-made for the user. For financial institutions, this could be a game-changer in their quest to truly understand and serve their clients.

- Unified Lending Platform: A significant highlight was the introduction of a unified lending platform, poised to revamp the loan origination process. Not only does this promise increased efficiency, but it also offers a seamless journey for customers – allowing for flexibility to start their loan application online and wrap it up in-person at a branch.

- More innovation in Wealth Management: Optimising goal planning experiences, unifying customer behavioural and financial data, and creating segments with intelligent insights.

- A Deep Dive into Insurance: It appears that Salesforce is leaving no stone unturned in the insurance sector. From introducing an insurance service console and marketing integration, to claims management, the Winter release promises innovations that will simplify and enhance policy management, from backdating changes to bundling different insurance products under one roof.

- Emphasis on Group Insurance and Benefits: The forthcoming enhancements in group insurance show Salesforce's commitment to refining every facet of insurance. With tools like large group coding, midterm adjustments, and tracking employee contributions, they are aiming for efficiency and simplicity.

- Access Control: The new framework that facilitates managing access control across different business lines is intriguing. Initial offerings cater to retail banking, with plans to branch out into wealth and insurance services soon.

- Harnessing AI: Salesforce’s vision for AI is deeply practical. By investing in areas like transaction disputes and customer service, they aim to utilise AI for automating tasks and refining processes. The intent to collaborate with chargeback vendors and enhance transaction processes further underlines the commitment. We’ve heard from customers like PenFed about how they use LLMs/generative AI in the context of contact centre automation.

- The fusion of Data, AI, CRM, and Trust represents the future of financial services.

- OmniStudio and more OmniStudio: FSC product is doubling down on OmniStudio, having invested in migrating the former Vlocity product into their core platform runtime for improved performance. Omniscript, Flexcards, DataRaptors and Integration Procedures might be good news for customers but not necessarily ISV partners as OmniStudio is not ISV-ready and cannot be included in managed packages.

- Ready-made APIs make lots of sense in certain use cases, like the BIAN-inspired framework for core banking integration, but are somewhat confusing in others, like IDV and document signature, where we already have plenty of AppExchange solutions. Salesforce is trying to encourage customers to use more MuleSoft, which still seems best suited for midsize to large financial establishments with intricate process management requirements.

Here are some not FSC-specific but equally interesting and important plans for customers in financial services:

- Einstein 1 Platform: A revamped AI platform by Salesforce emphasising seamless AI tool integration and data privacy with the Einstein Trust Layer.

- Einstein Copilot: Integrated into the user interface's side panel, it facilitates natural language interactions and offers enhanced multi-step action plan recommendations.

- Einstein Trust Layer: Bringing secure data retrieval, dynamic grounding, data masking for PII data, toxicity detection, auditing and zero retention to Salesforce customers.

- Free Data Cloud and Tableau licences for all customers using the Sales and Service Cloud, either in the Enterprise or Unlimited edition. Included in this complimentary offer are two Tableau Creator licences and Data Cloud licences that can be utilised for as many as 10,000 profiles..